The preface is that I am not an economist. Nor am I really interested in economics, finances, or anything to do with money.1 But I ran a small business briefly, am “good” with numbers/statistics, and did a lot of accounting when I was a maintenance foreman for a college. So I’m qualified to proclaim the following from the rooftops:

Economics is fake.2

Of course, economics isn’t entirely “fake.” People get real degrees and become regime-sanctioned experts in it. Economic calculations aren’t entirely false. Basic principles like supply and demand, price curves, and opportunity costs aren’t entirely wrong either. But economics and finance, the type practiced by so-called financial wizards at the Federal Reserve, the associated multinational banking corporations that control it and control our lives, the hedge funds, the BlackRocks, the Vanguards of the world, is a farce. It only creates “value”, “goods”, and “services” by the pressure it exerts, by manipulating people into desperation, debt, and despair from which more work, rents, fees, and “revenue” can be generated for the rulers.

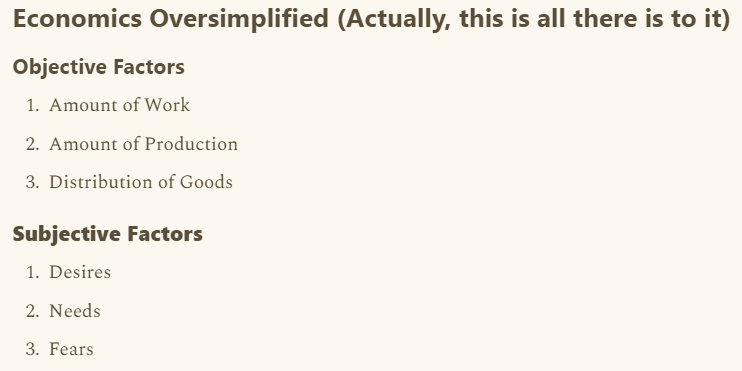

Aristotle barely bothered covering economics per se in any of his writings, only mentioning “oikonomia" (οἰκονομία) or household management, in the context of a household acquiring the resources it needs for survival—and when one family lives in political relationship with enough other families—those things needed for the good life. We must forget the complex language of today's economics and focus, like Aristotle did, on the outcomes that relate to human life itself. Economics is about goods and things delivered to people who have wants and needs, meaning we can divide our understanding of it between these objective good things and the subjective desires, needs, and fears which drive men toward and to work for these things.

To simplify, all that really matters in worldly affairs is stuff, the work required to make that stuff, who gets that stuff, and how much of it people need and want, a combination of three objective factors and three subjective factors as summarized here.

The “Tools” of Economics

The type of “economics” that is used and waved above the heads of the cowed, subjected masses as supposed occult magic tools that create wealth is merely the bag of tools of social control used to manipulate and enslave them, as

’s warnings about our common worship of GDP remind us:Wealth is nothing but physical goods and services or some token giving claim to the goods held by others, or the work time of others. Disprove it. Money is a token, a pure tool, nothing more and nothing less. Make more tokens and force people to take them at gunpoint, and you get their stuff. You haven’t created wealth. You’ve just distributed it differently. Some quibble today and point to information as a new form of wealth, but that is merely a tool for extracting goods and services out of other people. Political power is likewise but a way of getting things out of people. Nepotism, technology, and bureaucracy are all the same as well. These are all but means used by people in power over others to control what wealth is created and to extract more of it from people.

As the means of acquiring things and manipulating peoples’ behavior, the tools aren’t unimportant. Neither are these “tools” hidden occult secrets. The survival of any group of people larger than a family or anyone who wants more than a subsistence level of living requires that there be such indirect means of coordinating, directing, and controlling the redistribution of the fruits of human labor. Thomas Hobbes may not have been right about human nature, generally speaking, but he did have a point about the tendencies of fallen humans absent grace. Humans don’t always work well together. They have to be compelled somehow to achieve grandiose things, and this “force” often is exploitative. All the magicians of finance can do is find ways to affect human behavior in ways that make us work better together, work harder, work more efficiently, or give someone the benefits of our labor instead of someone else.

Wealth isn’t created by a new 401K law, a new tariff, a new unemployment benefit, a new special economic zone, or unionization. For the American “economy” to improve, there have to be more real goods and services produced in the country. Either Americans will have to do different work than they do now, or they will have to work more, work more efficiently, or somehow the goods we produce will have to be distributed differently.

We know this, and yet still often act as if the “economic tools” are magic panaceas toward some golden age that will fix our issues without any of us having to change our behavior. Only if these tools are used in a different way than they are now, to create a more efficient system, impel people to work harder or work more, or something of the like, would they have an indirect benefit.

Money is a Tool of Serfdom

Money, its supply, and its regulation are foremost amongst the economic tools used by the financial class (bankster elite). The Federal Reserve and its policies exert a huge drain, by way of constant inflation, on everyone. Rather than work a certain amount and save up over time, inflation forces everyone to run a little faster on the treadmill of “the grind.” Complex financial “products” out of which transaction fees and “cuts” can be extracted, as well as pressure to go into debt, add more pressure, and therefore more control. Money as a medium of exchange is useful to everyone. Money is a useful tool. But because it is a token, it is almost always used for manipulation. He who controls the token controls all for which it can be exchanged.

To a degree, I empathize with the needs of the elite. We all suffer through this, but we also all benefit from the fact that someone, due to economic need, is forced by the constraints of the money system, most of all inflation, to work hard jobs at poor hours, with little compensation or to get into debt and pay large amounts of interest. We benefit from the hard work of others performed under their fear as well as from the mutual usury that our system’s extractive complexity is based upon. Rather than directly buying things after saving up for them, our highly mediated, highly debt-filled habits merely ensure that all of us are in debt, that the financial system extracts a cut, and also that we get some of it back in interest, investments, and other kickbacks. While this might seem to make the whole process less usurious, as many debtors are simultaneously benefiting from the debt of others, it’s actually worse. It makes us all guilty of usury within the system because we all benefit from it, even as many of us also hurt from it. In our system, just like under Soviet Communism, we all take turns oppressing each other like crabs in a bucket.

The Serfdom of Bureaucratic Red Tape

The bureaucratic processes, customs, and endless regulations under which we labor are themselves another tool of enslavement. By forcing work to conform to a preset, set of corporate and government plans, standards, threats, taxes, tolls, forms, registrations, and procedures that the average worker can’t really do much to change, the opposite of the more relationship-oriented free-flowing habits of yore in the Middle Ages, workers are kept under control, kept within a system, and are easier to exploit. It’s easier to make them work more than they would otherwise, at the very least, and yes, you do have to buy some of them off by giving them “fake” or what David Graeber would give a far harsher term for,3 nonsense jobs with fluffy salaries and little effort. But the payoff is worth it. Fewer rebellions, consistent hours of work, and consistent results. The government bureaucrats fired by D.O.G.E. were merely the government examples of this category. Many other people work pointless jobs that aren’t really pointless. The “system” and its elite just prefer that people who could break out of the system are “paid off” to stay within the system and do a modicum of work to keep the system stable. I don’t like it, but it’s devilishly, Machiavellianly smart if you ask me.

We think economics is complicated, not because it is, but because the system of control that manipulates our behavior toward certain outcomes, somewhat for our benefit, but mostly for extractive purposes, is complicated.

It took a lot of effort to make the 2008 era subprime mortgage loan scam look legitimate and get people to put their money into it so that a few fraudsters could benefit. Every crypto-scam out there today4 requires a similar level of pretending that wealth and economics are complicated in order to work. We perform a similar level of pretending to pretend that usury isn’t usury and that money isn’t coming from somebody being screwed over.

The Tools of Compulsion Seem Necessary

No, what many of us labor under is not literal serfdom. The chains are soft, porous, and spun out of a million minor inconveniences and complexities. To do X, you have to do Y, which requires you to file Form Z, which requires you to first have forms A2 and F4 ready and wait in line to do J. You must pay for X item through a loan, even if you have money (and pay 30% more in interest)… You must start a new bank account…

Some degree of compulsion and pressure is needed to fill all the jobs and roles needed to sustain a complex technological society.5 Someone has to be pressured into the night shift, into being a janitor, into a “dirty job”, etc.6 To get all the work done to sustain a ruling class being able to leech off of those below them (not every ruling class is necessarily a leech, but I don’t think we’ve had a true aristocracy that’s non-oligarchic since at least 1914, if not since the 16th century) people have to be pressured to work more than they would otherwise. These are mathematical, practical constraints. Pressure is needed. Bureaucracy, money manipulation, and the tools of finance are the tools used to induce such pressures.

Fear of needs being unmet is the primary emotion induced by these tools, so control of desires (through advertising and mimetic social pressure, needs (through inflation, taxation, and regulation), and particular fears (propaganda, warmongering, psy-ops, false flags) are the tools needed to sustain a “stable” economic system. These are the subjective factors of economics to the objective triad of work, production, and distribution.

Are there ways out of the morass of control? Are there better ways to align our behavior with each other without the current, obviously overstrained, obviously oppressive, obviously extractive bankster system that we’ve had since a little creature hatched on a place called Jekyll Island?

Catholic social teaching, especially as expressed by Pope Leo XIII, suggests there is, but the details for me have always been muddy as to how distributism would work in practice. I’ll be looking more into that, but the beginning of a more real, workable system is ending our pretending that economics is complicated.

Half of me still hopes I become a monk (article forthcoming) and don’t have to worry about money ever again. The other half of me (article also forthcoming) tends in a very different direction, where it’s probably a problem that I’m so bad at being “smart” with money.

This is an emotional rant. It is not a treatise on economics. It might be obvious to you that I do not have traditional Reagan-esque views. Neither am I a leftist. I call myself, jokingly, a far-right libertarian leftist communitarian with the economic ideology of Mary’s Magnificat.

David Graber’s Bullshit Jobs is good, except for his positive proscriptions. The arguments of the book are summarized in a shorter way in this article: https://davidgraeber.org/articles/i-had-to-guard-an-empty-room/

That includes Trumpcoin, which, after

explained it, has been one of the biggest cracks in my view of Trump so far this term. I do have other concerns as well even as I still remain mostly positive on Trump.Of course, perhaps we don’t need to presume that we all want to live in an advanced technological society. Ted Kazynczki anybody? I’m torn. I also want to go to Mars.

Parties and Latin t-shirts by themselves don’t work. When I was a crew foreman, the thing that worked best for group work ethic and “happiness” while working was getting some of my crew together before work to pray an hour of the Divine Office together.

I actually studied economics in college... but I always preferred the simplicity of F. A. Hayek and Henry Hazlitt. The real lesson of economics is one that is often forgotten in the field today: there are no shortcuts, and everything is scarce. Trade-offs are a part of life.

The promise of the technocracy is a managed society in which scarcity, pain, loneliness, ignorance, crime, inequality, etc. can all be managed - smoothed out of the picture, somehow - and minimized by our educated professionals. That hasn't really turned out to be the case.

In response to every one of these problems we find the same tendency: create academic abstractions (based upon imperfect understanding and moral intuitions) and then try to impose them on reality, using the bureaucracy. If things improve, great. If they don't, the contradictions and the growing problems are ignored. Technocrats prefer to focus on things that they feel comfortable with, which tend to be issues that are framed in familiar ways and solutions that follow their rote schemes.

I'm no economist, but I scoff a bit when professionals pontificate about tariffs or finance or neo-Keynesian fiscal policy or A.I. If you KNEW what you were talking about (I think) - that is, if your professional training equipped you with a full and workable picture of these issues - we wouldn't have the problems we're having. How many economists predicted the 2008 financial crisis? Or the full effects of NAFTA?

Here's an idea: educations are of limited value. Tools are of limited applicability. Theories are necessarily flawed and incomplete. Rather than telling everyone what the shape of reality is, try listening to people, and keeping an open mind. This will erode your institutional power and reduce your professional status... but that's going to happen anyway.

You don't need to be a social scientist to see the cracks in the edifice.